Customer experience management is fundamentally about providing a seamless and consistent flow as prospects move through different phases of development and points of contact with a supplier. Delivering on this presumes a level of connectedness that many marketing organizations struggle to achieve. The reason for the struggle is that there are three significant forces of fragmentation opposing their efforts: specialization of roles, organizational hierarchies, and tactical technology. These forces threaten every marketing organization with two fatal flaws: they slow everything down and fracture the customer experience.

Three forces of fragmentation that marketers must fight:

1. Specialization: all areas of marketing execution have become inch wide mile deep endeavors. As a result, there can be many degrees of separation between key roles such as social marketers, event planners, web administrators, technical writers, etc. What do these people talk about when they get in a room together? Does anyone else care how the events person manages food service or logistics?

How to combat the fragmentation of specialization: It is becoming clear that the one thing all marketing roles now have in common is the need to master data and analytics. Each specialized role produces and consumes data from all the others. It is critical that everyone in marketing understand how customer and operational data flows, how others use the data they produce, and the best analytical practices for gaining insight. This should be a key topic of conversation and community building.

2. Hierarchical org charts: Marketing is no longer a command and control world. Yes, there is an overlay of reporting that has to go “up the chain.” For many marketing leaders that grew up with the traditional B-school approach to management, adding layers to the org chart is a natural approach. However it results in compartmentalization that left untended creates a culture of disconnectedness.

How to combat the fragmentation of hierarchies: Marketing organizations should be defined around processes not activities. Marketing processes must be supported by collaborative environments that foster greater visibility and coordination between contributors. Enterprise social networks are becoming essential for creating a culture of openness and connection. Organic approaches are not enough, marketing leaders need to seed the social network with process oriented communities such as: campaign management, sales enablement, content lifecycle management, etc.

Transforming Marketing From Silos…

… To Systems

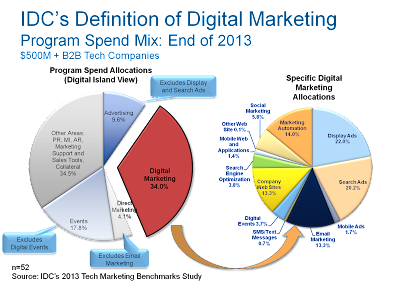

3. Technology: IDC identifies nearly 90 different categories of marketing technology (not including middleware and infrastructure!) That alone should tell you the function and the IT market serving it are unsustainably fragmented. The deployment of highly specialized tools can empower people within their specialties but can leave them on a technology island in the greater scheme of things. Major IT vendors have started to consolidate some of the basic building blocks, but there are still many areas in which niche/best of breed capabilities are needed.

How to combat the fragmentation of technology: The two centers of gravity for your marketing IT infrastructure are your integrated marketing management solution and your website. They should be intimately tied to each other and all other marketing systems/tools should integrate with one or both of them. This becomes a forcing factor for integrating processes and data flows. Marketers also need to demand more of their technology vendors to accelerate the evolution of platforms that tie together the systems of engagement, content, administration and data.

The most successful CMOs will ensure the pervasive deployment and adoption of technology increases collaboration, socialization, and systems thinking. They will design marketing organizations around customer-centric processes and exert deliberate efforts at all levels to combat the forces that threaten the connectedness needed to serve up a seamless customer experience.