Are IT Buyers so self sufficient that sales people will no longer be needed? Much was made in 2013 of the notion that IT Buyers make a large percent of their decision before engaging with sales. Every major market research company had its own number but they all ranged north of 50%, a scary thought especially if it represented a rising trend.

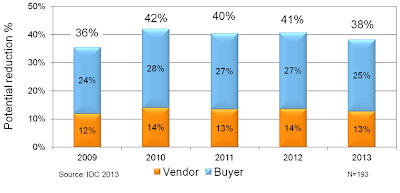

As shown in the figure below, enterprise IT buyers actually rely very heavily on vendor input for enterprise solutions. Buyers can make categorical decisions like “we need a new CRM or billing system.” But they need a great deal of information from marketing, sales and technical sales in order to complete their decision making processes.

Finding the Right Mix of Marketing and Sales Engagement

Q. What percent of your decision for an enterprise-level purchase when multiple vendors are competing for your business has been made by the time you first speak with a salesperson?

Source: IDC’s 2013 IT Buyer Experience Survey, n = 193

The implications for supporting customer journeys is significant. For purchases that are low cost, familiar and low risk customers want to be as self sufficient as possible. And sellers need them to be because it costs too much for even telesales or online chat to support these transactions. At the other end of the spectrum of course it gets far more complex and that translates into opportunity for vendors – if they are truly aligned with the buyer’s journey.

One of the most important value adds that most sales and marketing lacks is the need to educate customers on how to buy as much as what to buy. For costly complex purchases, customers need guidance on:

- How to evaluate the strategic priority of the solution as well as the technical and business benefits

- How to build consensus across line of business, corporate IT and other key players in the decision making process.

According to our latest IT Buyer Experience research, marketing and sales teams that provide this insight early and often will help buyers make their decisions up to 40% faster, putting them ahead of the competition and ahead of forecast.

For more information on this and related research please contact me at gmurray(at)idc(dot)com.